The current world monetary structure that has been in place since 1971 is coming to an end.

Though a transition/collapse is not imminent, the warning signs are accelerating.

As of today, Germany’s central bank announced that it has begun to repatriate a portion of its gold held abroad from current locations in NY and Paris:

Germany to repatriate gold worth €27bn

By Michael Steen in Frankfurt and Jack Farchy in London (Financial Times)

Germany’s Bundesbank will repatriate gold stored in foreign vaults in New York and Paris with a market value of €27bn by 2020, in a rare instance of the fiercely independent central bank bowing to popular disquiet about keeping most of its gold reserves abroad.

While insisting the decision in no way reflected any security or access concerns, the Bundesbank said all 374 tonnes of gold stored at the Banque de France would come home, as would some 300 tonnes out of a total of 1,500 tonnes kept at the New York Federal Reserve.

Germany is not the first country to repatriate its gold reserves. But others – including Venezuela, Iran and Libya – were typically reacting to fears of asset seizures as a result of international sanctions.

“In Germany, a lot of emotion is attached to the topic of gold reserves,” Carl-Ludwig Thiele, Bundesbank board member, told a news conference. “To hold gold as a central bank creates confidence . . . [We] build trust at home and have the possibility to exchange gold at short notice into foreign currency abroad.”

What is set to become one of the biggest planned gold transports on record will result in half of Germany’s gold being kept at the Bundesbank in Frankfurt and the other half split between the New York Fed and a smaller portion at the Bank of England.

Legendary Jim Sinclair released excellent insight into Germany’s actions:

I respectfully disagree with most of the explanations given today on the why of German actions in gold. My understanding is that the causal event of this notification actually came from the actions of the US Exchange Stabilization Fund and the long term plans to strengthen the euro.

I have published a chart from Patrick showing the extreme change in the ratio of gold to fiat currency presently being held in reserve by Euroland.

First you need to understand what the Exchange Stabilization Fund is and is not. It is an account at a major gold bank in the name of the Exchange Stabilization Fund. This fund can legally trade in gold and does. The President of the USA and the Secretary of the US Treasury run this fund. Those two managers by law are permitted to designate another manager if they wish. The fund can trade long or short, borrow or lend anything. Basically this is a an account that can legally do anything it wants whenever it wants in secret as the year end statement can easily be brought to only benign activates by warehousing all the trades.

Their broker is quite an expert in that strategy to wash year-end positions for clients.

What occurred as I am told is an act in Germany in reaction to a parting shot from the retiring Secretary of the US Treasury via the Exchange Stabilization Fund.

When gold traded at $1918 it was setting up for a challenge of a very important round number, $2000. The sell off was a product of long liquidation in an anticipation of $2000 in a fast market. Gold did fall on its own weight into the $1800 area, however the body block at $1800, $1775 and $1750 was a product of the Exchange Stabilization Fund operating as an account of a major Gold Bank. Seeing that, this gold bank went to the short side for the account of its hedge funds and not wholly owned trading arm. This gold bank issued a public statement that the gold market was dead as a doornail, finished and completed.

On the level of central banking there are no secrets. The long term plan for the currency war between the euro and the dollar is a derivation of the Free Gold Thesis. That means a significant change in the percentage of fiat currency versus gold at market value held by Euroland as reserves. This thesis has a target for cooperating Asian central banks for gold holdings at no less than 15% at market value. I question some of the thesis of Free Gold thinkers, but much of it has been in my writing for more than a decade on what the end game recovery will look like.

I am told that the parting shot to break gold’s back by the Exchange Stabilization Fund was considered a direct attack on the Euro strategy for what the end game recovery will look like. The Free Gold thesis requires significantly higher gold prices to work and to elevate the euro back in reserve by choice category.

The German reaction was not political but rather a direct warning that they could demand return of their gold just like DeGaulle of France did in the 60s by making a direct and immediate demand for conversion of the US dollar holdings into Gold.

A major central bank will not insult another major central bank unless it is an act of financial war. It has not come to that yet, but it is not that far away. It is 2015 to 2017 and not 2020.

The reason that gold is relatively firm after the media leak and release on the night of the 14th is that I am not the only person who knows the real story. The price of gold will go to and beyond $3500. Gold will be market to market by the majority, if not all, major central banks. This will balance the balance sheet of the many and major debtor nations and will provide the platform for recovery after unwinding.

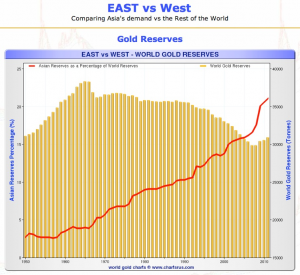

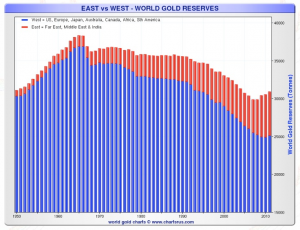

For those who are new to this trend, it may be important to look at the following charts:

(click on image to enlarge)

(click on image to enlarge)

The previous two charts illustrate the increasing accumulation of gold by eastern foreign central banks. China, Russia, India, Kazakhstan, and numerous other countries including Mexico, Brazil, Venezuela, the Philippines, Turkey, Iran, South Korea, et al. have all been accumulating.

It must be reiterated that gold is not an investment. It is money. Paper currencies the world over are in trouble and the move by foreign central banks to diversify out of paper currency and into gold is a strong indication that the debt based (faith based) monetary system is struggling.

It is vital that you remain cognizant of this move and participate on an individual basis by accumulating yourself.

In addition, today on the front page of Bloomberg we see this:

Russia Says World Is Nearing Currency War as Europe Joins

By Simon Kennedy & Scott Rose – Jan 16, 2013 11:24 AM ET

The world is on the brink of a fresh “currency war,” Russia warned, as European policy makers joined Japan in bemoaning the economic cost of rising exchange rates.

“Japan is weakening the yen and other countries may follow,” Alexei Ulyukayev, first deputy chairman of Russia’s central bank, said at a conference today in Moscow.

The debt based monetary system that is in place is unsustainable. As central banks the world over continue to print money in order to stimulate their economy, finance their government spending, weaken their currency in order to increase exports and remain competitive, or ultimately in order to keep the current system alive, the fact remains that it all can not last indefinitely. Therefore, we must accept that the currency wars will only intensify, and most likely end unfortunately in actual shooting wars (If you have not read Jim Rickards Currency Wars I recommend you do so).

I am NOT advocating that the end of such system is imminent, but I am warning that the trend to move away from the current US dominated system is well under way and accelerating.

Please ask yourself these very simple questions:

Will the US ever balance its budget?

Will the US ever pay off its national debt?

What will happen when interest rates rise?

The US, the whole world for that matter, is truly in a pickle with no way out except for default and restructuring.

Of course the party will continue until the music stops, as it did in 2008.

What we must ask ourselves, is what will be the solution the next go around?

The globalist architects desire war. What do you desire?

{ 0 comments… add one now }